Roth ira return rate

Roth IRA Withdrawal Rules. Find out what tax deductions you can and cant take when it comes to your Roth IRA.

Real Estate Shines As An Investment In 2015 Investing Real Estate Tips Real Estate

A Roth IRA lets you accumulate earnings on a tax-deferred basis and withdraw earnings tax free for qualified distributions.

. They live and. One annual 6000 IRA contribution made on January 1 of the first year a 7 annual rate of return and no taxes on any earnings within the IRA. 35 of these 36 funds beat their Lipper average for the 10-year period.

So your Roth IRA return rate depends on what youre invested in just like with any other brokerage account. Retirement Account decreases you might wonder if there is a way. Assuming an annualized 7 growth rate.

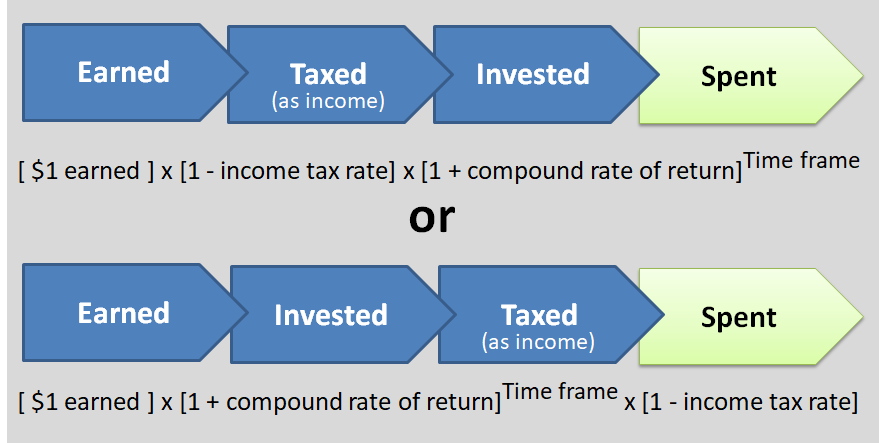

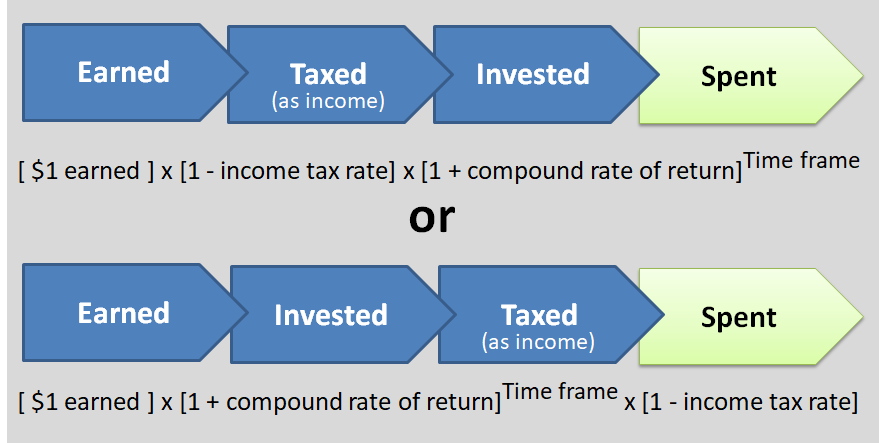

Designated Roth employee elective contributions are made with after-tax dollars. That means your returns could vary widely. Roth 401k Roth IRA and Pre-tax 401k Retirement Accounts.

The ending values do not reflect taxes fees or inflation. -0- if married filing a separate return and you lived with your spouse at any time during the year or. One of my most popular posts is the tutorial on the processIn the lengthy comments section of that post many people asked how to handle a Backdoor Roth IRA especially form 8606 if you contributed in the next calendar yearWhile it is cleaner to make.

Going back to our example lets say the value of the Roth IRA drops from the initial 50000 to 35000. Read the 7 things to should know about Roth IRA conversions here. A Roth IRA is an individual retirement account IRA under United States law that is generally not taxed upon distribution provided certain conditions are met.

The funds must also remain invested for at least five years unless some special circumstance permits otherwise. Get tips on sidestepping traditional Roth IRA limits with an account for higher-income individuals. Your Age 5-Year Rule Met Taxes and Penalties on Withdrawals Qualified Exceptions.

Unlike a Traditional IRA contributions to a Roth IRA are not deductible on your federal income tax return. Traditional pre-tax employee elective contributions are made with before-tax dollars. 1 Earnings may be taxed at your tax rate and a 10 tax penalty for an.

Home financial roth ira calculator. 0 of 44 37 of 40 and 37 of 40 of the Retirement Funds outperformed their Lipper average for the 1- 3- and 5-year periods ended 6302022 respectively. If you then convert the account to a Roth.

Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. Fortunately you can avoid this unfavorable outcome by reversing the Roth account back to traditional IRA status. The annual rate of return is the amount the investments in your Roth IRA make in a year.

Many high-income professional investors first learned about the Backdoor Roth IRA on this site. Claimed it as a deduction on your 2021 tax return. When the value of your investments in a Roth IRA Roth Individual Retirement Account decreases you might wonder if there is a way to write off those losses on your federal income tax return.

The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan qualified withdrawals from the Roth IRA plan. This is because all things being equal the rate of return is generally higher for a Roth IRA because no taxes are due for any gains in a Roth IRAand taxes reduce the. 5500 current value minus the 5000.

Mutual funds are managed by teams of investing professionals who make sure the mutual fund performs at the highest level possible. Divide the result in 2 by 15000 10000 if filing a joint return qualifying widower or married filing a separate return and you. However since you have already paid.

An investor who uses a Roth IRA must defer taking any distributions until at least age 59 12 to achieve this completely tax-free status. The Roth IRA calculator defaults to a 6 rate of return which should be adjusted to reflect the expected. 36 of our 44 Retirement Funds Investor Advisor and R Class had a 10-year track record as of 6302022 includes all share classes.

The stock market historically has an annual average rate of return between 1012. You would report 500 of income on your tax return. Balance at Age 65.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. You can open a Roth IRA for your kids but there are some important rules you need to know first like tax laws. 125000 for all other individuals.

Designated Roth 401k Roth IRA. On the other hand if your child is 15. A Roth IRA even via a conversion has the potential to benefit your retirement and legacy planning.

Amount of Roth IRA Contributions That You Can Make For 2021. Youll still have a 45000 taxable distribution from the conversion even though the Roth account is now worth only 35000. The hypothetical examples assume the following.

Roth IRA contributions are made with after-tax dollars. With a Roth IRA you wont pay any taxes on the money you take out in retirement once you hit age 59 12. You could use your Roth IRA to hold short-term bonds with modest returns or aggressive stocks that can yield larger gains but may also result in losses.

Illustrating The Value Of Retirement Accounts Retirement Accounts Accounting Investing

Do You Want To Double Your Money The Rule Of 72 Will Show You How Long It Will Take And I Will Show You How To Speed Up The P Rule

How I Built A Tax Free Portfolio With 15 Annualized Returns Retirement Portfolio Dividend Stocks Investing

Bd A Are You Able To Save More Money Mag Battle Low Returns By Saving More Finances Money Smart Money Saving

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Here Is Where Your 401k Savings Vs Your Age Net Worth Good Work Ethic Personal Finance Blogs

Help Protect Retirement Income Understand Sequence Of Returns Risk Charles Schwab Retirement Portfolio Retirement Income Understanding

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Home Nextadvisor With Time Investing For Retirement Finances Money Money Management

What Drives Returns In A 60 40 Portfolio Novel Investor Bond Charts And Graphs Portfolio

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Understanding Your Tax Return Income Flows

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Step Guide Financial Independence Roth

How To Build A Nest Egg Investing Investing Infographic Start Investing

How To Confidently Buy An Investment Property My Go No Go System Buying Investment Property Investment Property Investing

Compounding Growth Visualization Roth Ira Investing Early Retirement

Annual Asset Class Returns Novel Investor Charts And Graphs Class Graphing